Tag: smartphones

-

The next mobile UI (why nobody has a clue)

by

Andrew Orlowski

–

How things have changed. Fifteen years ago attendees at a select mobile conference might have been found sparring over spectrum allocation and control channels. Back then, 3G loomed large, and huge geo-political battles were being fought. Today the talk is – how do you make it all work nicely?… Read More

-

Nokia ends cruel and unusual ‘Symbian programming’ practices

by

Andrew Orlowski

–

Nokia has bowed to international pressure and agreed to end the cruel and unusual practice of programming natively for the Symbian OS. It still wants developers to target Symbian, but using the more humane Qt APIs instead. Nokia has also torn up the OS roadmap, and will speed up the delivery of new functionality to…

-

When Dilbert came to Nokia

by

Andrew Orlowski

–

You may have had your fill of Nokia analysis and features, but I’d like to draw your attention to one more – one that’s very special. The Finnish daily Helsingin Sanomat has published a report based on 15 interviews with senior staff. It reads like the transcript to an Oscar-winning documentary where the narrative thread…

-

Why Android won’t worry RIM and Apple

by

Andrew Orlowski

–

My US colleagues are regulars on John C Dvorak’s excellent Cranky Geeks and a highlight of the show. I was recently intrigued to hear the opinion from Vulture West Coast (in Episode 232) that RIM was toast, and Android would triumph. Now, bearing in mind that I’ve been wrong about mobile more than I’ve been…

-

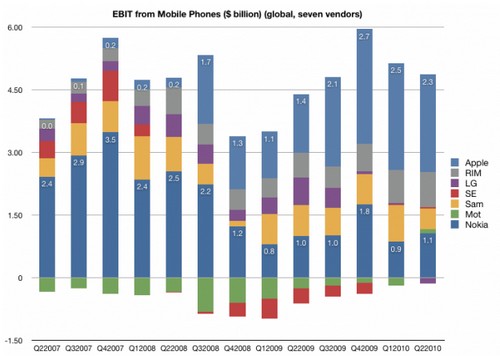

Mobile phones: where does the money go?

by

Andrew Orlowski

–

Dediu’s analysis is a good one: winning the commodity smartphone battle really isn’t a battle worth winning. It’s another example of the delusion that turnover is as important as profit. One of the oldest mottos at Vulture Central is Show Us The Money. There’s one even better, I think, which is Show Us The Profits.…

-

Rescuing Nokia? A former exec has a radical plan

by

Andrew Orlowski

–

A couple of months ago, a book appeared in Finland which has become a minor sensation. In the book, a former senior Nokia executive gives his diagnosis of the company, and prescribes some radical and surprising solutions. Up until now, the book has not been covered at all in the English language. This is the…